Highlighting how vendors can stand out in a crowded marketplace

By Ian Jordan, Director of Consulting, and Cam Manning, Senior Investment Associate | May, 2024

The rise of employee benefit point solutions

In the evolving landscape of employer-sponsored healthcare, point solutions are now widely adopted. They exist to improve the health and wellness of an organization through added coverage that falls outside conventional, mandatory benefits. Their primary purpose is to provide tailored services that enhance overall employee satisfaction and retention.

However, employee benefits brokers, consultants, and employers are now inundated with hundreds of these vendors. The latest data suggests that 50% of all employers provide access to between four and nine point solutions1, with some reports indicating even higher figures. This explosion in the market is driving fatigue in vendor selection, higher administrative costs for employers, and lower levels of utilization among employees, many who don’t realize which ones they have access to.

A fragmented market

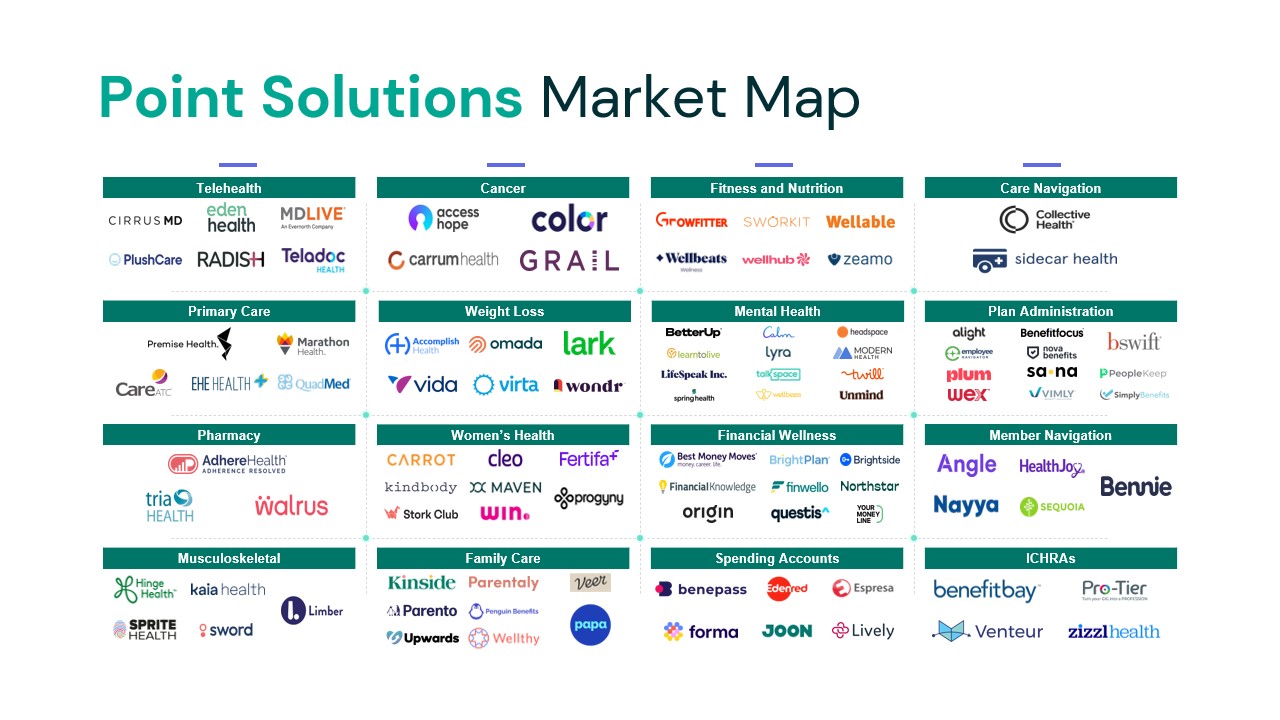

The growing number of point solutions has created a fragmented market containing a wide s assortment of “points” for different employee needs, ranging from mental health support to financial wellness programs to fertility services.

The sheer number of options is daunting for employers to navigate and challenging for vendors to stand out against the competition. As more and more enter the ring, employers struggle to compare and choose the right solutions, while vendors face fierce competition.

The graphic below illustrates a small sample of the fragmented point solution landscape.

The graphic below illustrates a small sample of the fragmented point solution landscape.

Employer pain points

Selection overload

Employers face a major challenge when comparing and implementing point solutions. While some vendors attempt to simplify the process by bundling multiple benefits, these “one-size-fits-all” approaches often backfire. Sometimes bundling sacrifices depth and functionality in favor of variety, which diminishes the value of each individual solution. Furthermore, point solution vendors sometimes chase trends without true expertise, leading to a cluttered market with competing, shallow offerings. This incoherency dilutes the effectiveness of each individual solution and makes it harder for employers to unlock the true value of the bundle. As a result, the overall package becomes less attractive, and discourages employers from engaging with certain vendors altogether.

Integration headaches

New solutions that don’t seamlessly integrate with existing benefits and systems, create data silos and administrative burdens for employers. Furthermore, these problems muddle the process of tracking employee engagement and utilization of the new benefits – a must when trying to demonstrate value and be retained as a vendor.

Ambiguous ROI

Moreover, many vendors struggle with demonstrating a clear return on investment (ROI) or the ability to attribute positive outcomes to their solution. Employers and brokers struggle to financially justify adding new benefits without clear evidence of sustainable savings. They often hear wildly optimistic claims about outcomes such as absenteeism or recidivism, which makes them skeptical. They are looking for clear, data-driven evidence that directly links the vendor’s solution to the promised ROI. Most solutions are attempting to do this through cost savings – usually via health claims or by boosting productivity, meanwhile, health insurance premiums are climbing by more than 6-7% (conservatively) each year.2 This lack of data discourages decision-makers from adopting new solutions solely based on financial projections.

Mismatch of priorities

Some vendors struggle to demonstrate alignment between its offering and the employer population. Those that are not tailored to fit the specific characteristics and needs of an employer’s workforce fail to provide meaningful value. A musculoskeletal point solution might not be a great fit for an employer with a younger population that does not have physical demands at work. Conversely, it can be a great fit for an industrial employer with an ageing workforce.

5 ways solution vendors can differentiate themselves in a crowded market

1. Define a clear product strategy

A defined product strategy is required to effectively understand how your point solution addresses distinct employer needs. One strategy is to be the best-in-class vendor within a specific area. This hyperfocus instills confidence through superior service and innovation, thereby attracting employers or brokers seeking targeted results. Another approach is to strategically bundle “points” that address closely related conditions without comprising efficiency.

Regardless of the chosen strategy, demonstrating a clear ROI is vital. Integrating claims data or utilizing a robust data analytics engine can provide compelling evidence of the solution’s impact, justifying the investment and securing its adoption by employers.

2. Align with the employer population

It is crucial to understand member population demographics such as current access to care, coverage, location, size, and industry. By analyzing demographics, you obtain valuable insights into member behavior and can better predict engagement levels. This knowledge empowers you to develop targeted features that address specific needs, ultimately driving higher utilization.3

3. Develop channel partnerships

Establishing channel partnerships with Third-Party Administrators (TPAs), benefit administrators, benefit marketplaces, health plans, and other related point solutions promotes member access and interoperability.

According to some members of the RAD Collective, an industry group of health insurance brokers and consultants, relationship-building with TPAs and other intermediaries is key as they hold significant influence over employer selection. By demonstrating how your solution cuts costs and boosts employee health, you can win them over as allies in reaching new customers.

4. Tailor value propositions for each key stakeholder profile

Benefits decisions are rarely made by a single person. Employers involve Finance (up to the CFO) and HR (including the CHRO) to weigh in. Plus, employee benefits brokers, consultants, and health plan executives all influence the benefit plan design.

Although each of these stakeholders want employees to have access to and utilize best-in-class solutions, their priorities are not uniform. A human resources (HR) buyer is likely to value a strong benefits experience and employee engagement more than a finance professional. A finance professional is often laser-focused on how a solution will affect health insurance premiums and prescription drug costs. A broker will usually want to balance putting trusted solutions in front of their clients while being seen as bringing innovative options to the table.

Point solution vendors must consider all these objectives while appropriately emphasizing the needs of the stakeholders with whom they are interacting.

5. Understand the buyer’s personal connection to the solution

A successful go-to-market strategy must leverage the buyer’s personal motivations. The HR department is involved in making sure they offer the most comprehensive benefits package that aligns with the current needs of employees. The finance department is concerned with being good stewards of capital. It is essential to showcase how your solution can support their intentions. Understanding the personal connections of these decision-makers can be a key advantage for vendors. For instance, an HR buyer or benefits broker who is starting a family and taking care of an aging parent is more likely to be engaged with caregiving support offerings whereas someone experiencing chronic illness may be more interested in pharmacy or musculoskeletal benefits.

Positioning for impact

The rise of employee benefit point solutions promises to fill gaps in traditional health plans. However, a fragmented market with limited integration and unclear ROI creates challenges for both employers and vendors. To stand out in the crowd, employee benefit solutions should target their solution, demonstrate clear value, build channel partnerships, and define a clear product strategy. By addressing the challenges of a crowded market and adopting a customer-centric approach, vendors can define their position in the market, deliver true value, and benefit employers and employees alike.

Sources:

- Wellframe. Point Solution Fatigue in Health Management

- KFF and Health Affairs. KFF Employer Health Benefits Survey

- Milliman. Best practices: Is your point solution on point?

This article was produced by Archetype. About the authors: Ian Jordan is Director of Consulting at Archetype and leads engagements primarily in the employee benefits, digital health, and insurance industries. He has over a decade of experience developing and implementing growth strategies for his clients of various sizes. Cam Manning is a Senior Investment Associate at Archetype identifying, investing in, and building innovation for our portfolio companies in the Archetype Funds. Prior to joining Archetype, Cam worked in corporate development at IDG.

Certain statements made in this report which are not historical and are based on the Archetype’s current expectations, estimates, and projections about future events may be deemed forward-looking statements. These forward-looking statements include information about future events. The forward-looking statements are based on the Archetype’s beliefs, assumptions, and expectations, taking into account all information that is currently available. These beliefs, assumptions, and expectations can change as a result of many possible events or factors, many of which are not currently known. The statements contained in this report, including any forward-looking statements, speak only as to the date they are made, and Archetype is not obligated to update or revise any of these statements, whether as a result of new information, future events, or otherwise, except to the extent otherwise required by law.