Navigating the Bullish Wave:

Insurance Brokerage M&A Persists in 2023, An Optimistic, Yet Cautious 2024

By Chetan Bagga, CEO, CIO, and Managing Partner and Cam Manning, Senior Investment Associate

February 9, 2024

2023 M&A Recap for Insurance Brokerages

In 2023, insurance brokerage M&A activity showed remarkable resilience despite the economic uncertainties related to inflation and interest rate expectations. Transaction volume remained at near-record levels and valuations continued to rise.

Insurance companies focused on deals that resonated with their strategic objectives. This included enhancing their digital footprints, adopting customer-centric models, and expanding into new specialties and geographic regions. Once again, the industry observed significant consolidation from private equity-backed companies employing rollup strategies. M&A emerged as a crucial blueprint to overcome shifting market dynamics and evolving customer preferences.

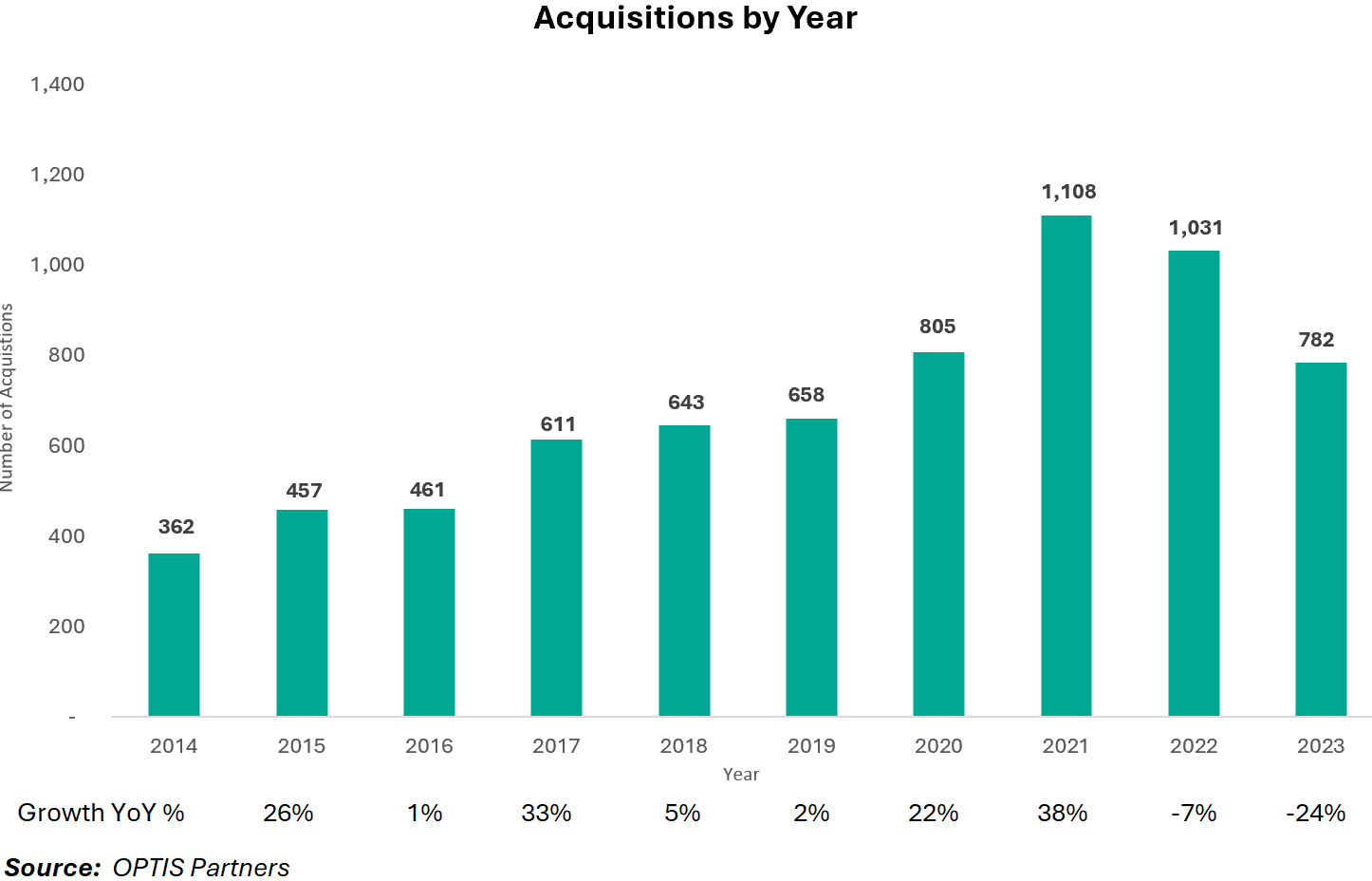

Another Solid Year for 2023 M&A Volume

Insurance brokerage M&A persevered in 2023 with a total of 782 announced transactions. Although this marked a 24% decrease from prior-year levels, the data highlighted another impressive year for total transaction volume across the insurance industry. The data also showed a normalization in deal activity after the sharp spike experienced post COVID-19 as active buyers adjusted focus to integration efforts and balance sheet rationalization.

PE-Sponsored Companies Propelled Demand

With an abundance of dry powder and appetite for broker consolidation, PE-backed insurance companies paved the way, accounting for 69% of the total transaction volume. Property and casualty insurance (P&C) companies comprised 472 transactions, or 60% of the activity, and employee benefits brokerages accounted for 103, or 13% of the total. Other sellers included third-party administrators, managing general agents, life insurance agencies, and other insurance distribution agencies.

Large Brokers Led Transactions

Twelve buyers represented 56% of all announced transactions in the year. Notably, the top four active buyers among these – Hub International BroadStreet Partners, Inszone Insurance Services, and World Insurance Associates – were responsible for 26% of the total 782 transactions.

Expertise and Reduced Supply Boosting Valuations

Strong-performing platform businesses and competition among PE-backed companies contributed to rising valuations. Compared to 2022, EBITDA multiples for platform business rose 14.3%, from 16.35x to 18.68x, with the average for all firms increasing by 7.8%, from 13.78x to 14.85x.

2024 Insurance Brokerage M&A Market Outlook

Overall, the 2024 M&A market outlook for the insurance brokerage industry is cautiously optimistic. The general economic forecast remains increasingly positive, and the market has already factored in reductions in interest rates by the Federal Reserve. Such a shift could fuel new activity among buyers, further driving up demand. However, uncertainty remains around the timing of lower interest rates and the quality of sellers in-market. Despite macroeconomic conditions, the industry should still see a continuation of prioritizing customers, integrating automation throughout the technology stack, and focusing on efficient financial practices. As a result, we expect to see increased transaction volume and rising valuations in 2024.

Overall Outlook

- Resurgence in deal activity: Pent-up activity from the uncertainty in 2023, coupled with stabilizing economic factors like interest rates and inflation, is expected to fuel a rise in M&A activity in 2024.

- Regulation: The insurance industry is projected to be influenced by regulatory changes affecting cybersecurity and artificial intelligence, the heightened private equity engagement in the life and annuity sector, the ERISA fiduciary rule, and the implementation of the “Pillar 2” global minimum tax.

Key Drivers

- Technological advancements: Integration of AI, automation, new InsurTech vendors, and data analytics becomes a major driver for M&A, as established insurance brokerages look to stay ahead of the curve.

- Market expansion: Major U.S. players are expected to continue acquiring middle-market brokers, both to broaden their national presence and penetrate larger international regions with higher growth potential, such as the emerging markets of Asia-Pacific.

- Customer-centricity: Transactions that improve the customer experience and broaden product selections, either through diversification or extension of distribution channels, will also drive volume.

Archetype Perspectives for 2024

In preparing for the year ahead, brokers should:

- Anticipate additional cost hikes leading into the 2025 plan renewal cycle and partner with clients to develop a variety of cost-effective strategies for implementation.

- Stay abreast of AI developments and explore ways to incorporate the technology into solutions.

- Understand the factors driving pharmaceutical costs and explore potential remedies.

- Address margin compression and tackle the challenges associated with talent acquisition.

The 2024 Insurance Brokerage M&A Market Outlook presents a landscape of both opportunity and challenge. The anticipated resurgence in deal activity, driven by more favorable economic conditions and technological advancements, suggests a dynamic year ahead. However, this optimism is tempered by the need for strategic alignment and restrictive global regulations. Key trends such as a shift towards high-quality acquisitions, market expansion, and a continued emphasis on customer-centricity are poised to shape the industry’s trajectory.

Concurrently, firms must navigate potential pitfalls, including the evolving geopolitical landscape, regulation concerns, and the complexities of talent management post-investment. As the industry steers through these various factors, its ability to adapt and innovate will be crucial in capitalizing on the opportunities that 2024 presents, ensuring both growth and resilience in an ever-changing market.

Sources:

- MarshBerry Q4 2023 M&A Trends Report

- Deloitte 2024 Global Insurance Outlook

- North American Agent & Broker 2023 Report

- McKinsey & Company: Insurance investors: Priorities and Opportunities

- 10 Things Insurance Companies Should Be Thinking About in 2024

__________________________________________________________________________________________________________________________________________________________________

This article was produced by Archetype. Contact Chetan Bagga directly to learn more about our approach to investment at Chetan.Bagga@archetypegrowth.com.

Certain statements made in this report which are not historical and are based on the Archetype’s current expectations, estimates, and projections about future events may be deemed forward-looking statements. These forward-looking statements include information about future events. The forward-looking statements are based on the Archetype’s beliefs, assumptions, and expectations, taking into account all information that is currently available. These beliefs, assumptions, and expectations can change as a result of many possible events or factors, many of which are not currently known. The statements contained in this report, including any forward-looking statements, speak only as to the date they are made, and Archetype is not obligated to update or revise any of these statements, whether as a result of new information, future events, or otherwise, except to the extent otherwise required by law.